D&B revolutionises its Payment Fraud Detection System with NashTech

Introduction

NashTech collaborated with the Dun & Bradstreet engineering team to identify the business needs and document critical non-functional requirements. This led to a reduction in response time from days and weeks to 30 mins to detect fraud and report to analysis.

The challenge

For partner organisations relying on the Dun & Bradstreet platform, timing is the most critical factor. If there is a bankruptcy report or a default payment in the credit history of one of the companies that a partner organisation is associated with, then they would need to get alerts on that immediately. But what made this difficult was the fact that there were millions of customers, which gave rise to huge volumes of alerts on an hourly basis.

Major challenges that D&B was facing:

- The system’s performance was not up to the desired standard. The platform was slow and sluggish. For instance, if an organisation had signed up for a package that allowed them to receive alerts of any payment frauds or defaults within 4 hours, it took as long as 24 hours. Since timing was a critical factor, this was an unaffordable drawback.

- The system was unable to scale and work seamlessly in high-load scenarios as it was handling millions of customers and huge volumes of alerts.

- The addition of new functionalities to the platform was a challenge.

The Risk Management platform needed an addendum for an efficient payment fraud detection mechanism

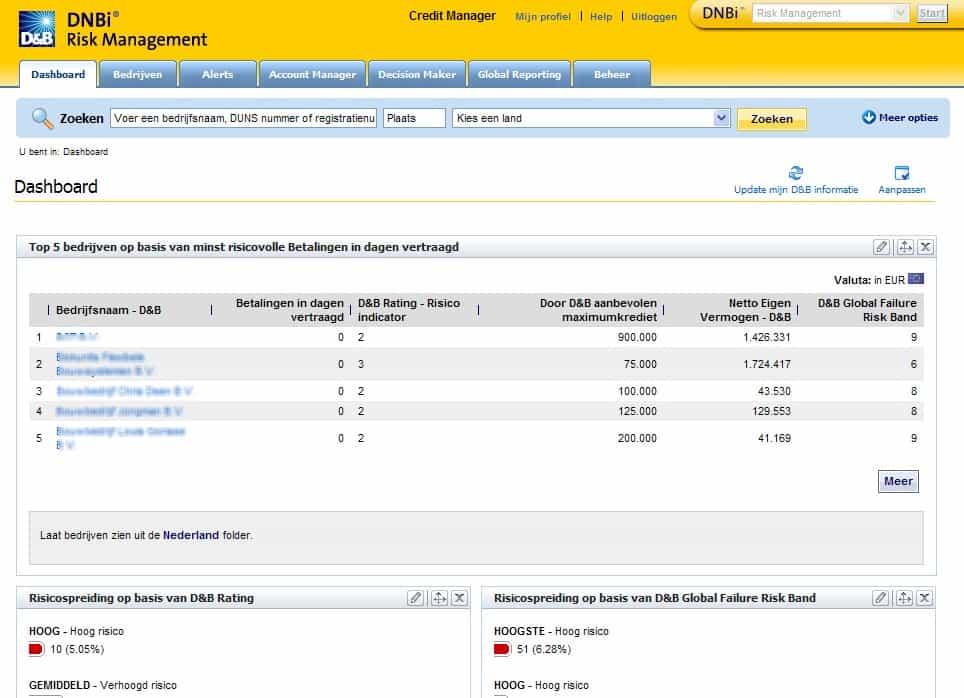

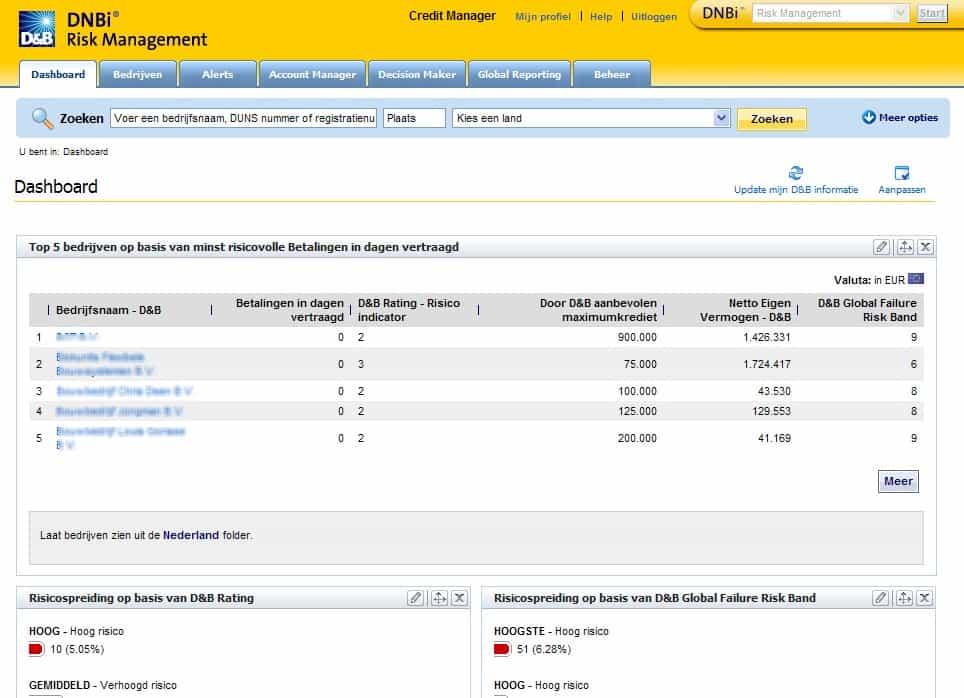

Dun & Bradstreet’s risk management platform allowed partner organisations to access deeper intelligence to get a clear picture of the credit history, payment defaults, or potentially fraudulent activities of the organisations they were doing business with. This helped them to mitigate risks by receiving notifications & alerts whenever a business begins to pose a threat in the future.

And for this, the system needs to be efficient and meet the SLAs; alerts & notifications have to be processed fast so that the partner organisations using the platform can modify their business strategies right on time so that they don’t suffer any losses. However, there were significant roadblocks to achieving D&B’s goals because of the challenges that the Risk Management platform was bringing out.

Let’s understand these challenges at a deeper level.

The solution

Succeeding in fraud analytics

NashTech collaborated with the Dun & Bradstreet engineering team to identify the business needs and document critical non-functional requirements. D&B wanted to make sure that it meets all the requirements of its service-level agreement (SLAs) The solution was laid down with:

• Complex event processing Conventional data management architectures could not suffice as there’s a lot of uncertainty involved when it comes to fraud detection of any kind. Therefore, many real-time event-driven applications like a fraud prevention system rely on Complex event processing.

• A complex event processing (CEP) approach enabled D&B’s system to detect fraudulent patterns in a company’s credit history with immediate effect and initiate communication with the concerned party. CEP enables matching of incoming events in near real-time to a pattern so that businesses can receive the latest insights and higher management can act upon it in the real-time. For instance, if a credit card customer swipes his card in California, it is not likely that he/she will swipe the same card in the UK. Esper was used for complex event processing along with GridGain on which all the data crunching was done for timely alerts.

• Duplication of alerts was removed The alerts that were applicable to multiple clients were not regenerated, rather they were re-circulated so as to remove the duplicate instances and thus drastically improve the efficiency of the system.

• Test Harness with a CI/CD pipeline As the system was lacking a lot of test scenarios, it presented challenges while adding new functionalities to the platform and launch new features on time. To solve this problem, we introduced a test harness for the system along with CI/CD pipelines which means we covered the entire system with an end-to-end test suite. A test harness introduces automated test frameworks that allow the system to be tested under varying load conditions.

• Scala was the language of choice Scala Programming Language was used to writing concise and maintainable code which was further extended to Akka.

A glimpse of D&B’s Risk Management Platform

Technical Architecture

The outcome

• Faster Alerts & Business Insights: Reduced the response time to 30 mins from days or weeks to detect fraud and report to analysis.

• Handle 8X Alerts: The system handles 8x the volume of alerts now that it was earlier able to and is scaling horizontally on GridGain.

• Onboard 3X Clients: Dun & Bradstreet was able to onboard many more clients as the system could now function under varying load conditions.

Read more case studies

Confident modernisation through the iPoint-NashTech partnership

NashTech implemented automation testing to overcome maintenance and management challenges associated with former NettingEQ service infrastructures and codebase.

VietinBank and NashTech – Award winning digital transformation with ‘Genie’ AI Chatbot

VietinBank, one of Vietnam’s largest and most prestigious banks and part of the nation’s “Big 4”, partnered with NashTech to drive digital transformation through the implementation of an advanced AI...

Building a long-term partnership with SLR Consulting

We worked with SLR to deliver a range of digital solutions including a sustainable digital business card platform, a smart room booking system for desks and parking, an automated supplier onboarding...

Let's talk about your project

- Topics:

Our partnerships